As a tech consultant for startups, I often hear people misusing multiples and percentages. As a primer, here's a simple table showing you what things look like when you buy and sell a company.

| Starting Cash | Ending Cash | Percentage of Return | Return Multiple |

|---|---|---|---|

| $1M | $1M | 0% | 1x |

| $1M | $1.5M | 50% | 1.5x |

| $1M | $2M | 100% | 2x |

| $1M | $3M | 200% | 3x |

| $1M | $4M | 300% | 4x |

| $1M | $5M | 400% | 5x |

| $1M | $6M | 500% | 6x |

| $1M | $10M | 900% | 10x |

| $1M | $20M | 1,900% | 20x |

| $1M | $100M | 9,900% | 100x |

| $1M | $1B | 99,900% | 1000x |

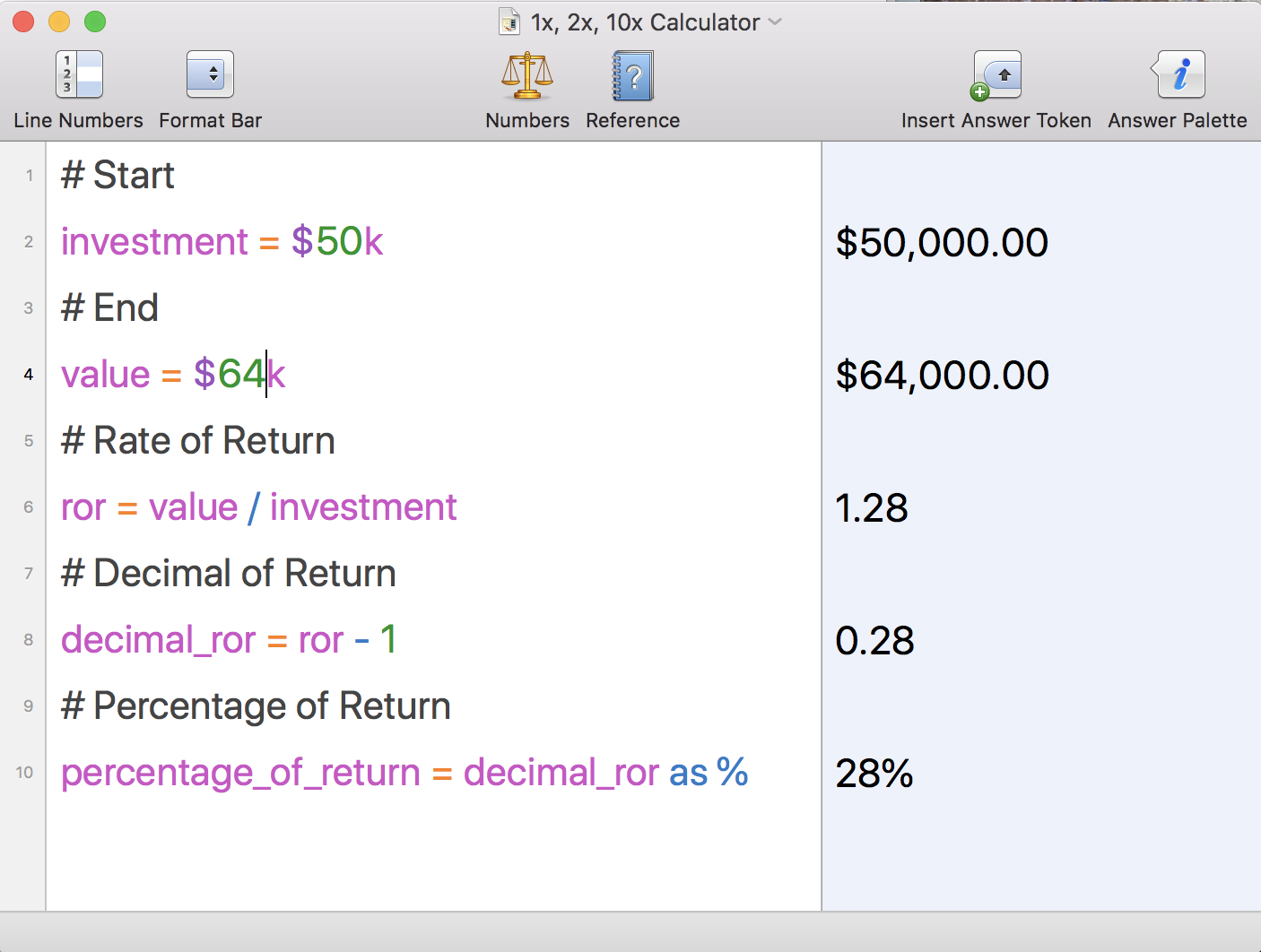

How to Calculate Return on Investment

If you invest $50k into a project and receive $64k, then your Return on Investment is 28%. You calculate this by subtracting the current (or expected) value from the original, then divide again by the original.

For those of you who like algebra, here's a second way to show the same info.

# Starting Investment

investment = $50k

# Current (or expected) Value

value = $64k

# Rate of Return / Return on Investment

ror = value / investment

# Decimal of Return

decimal_ror = ror - 1

# Percentage of Return

percentage_of_return = decimal_ror × 100

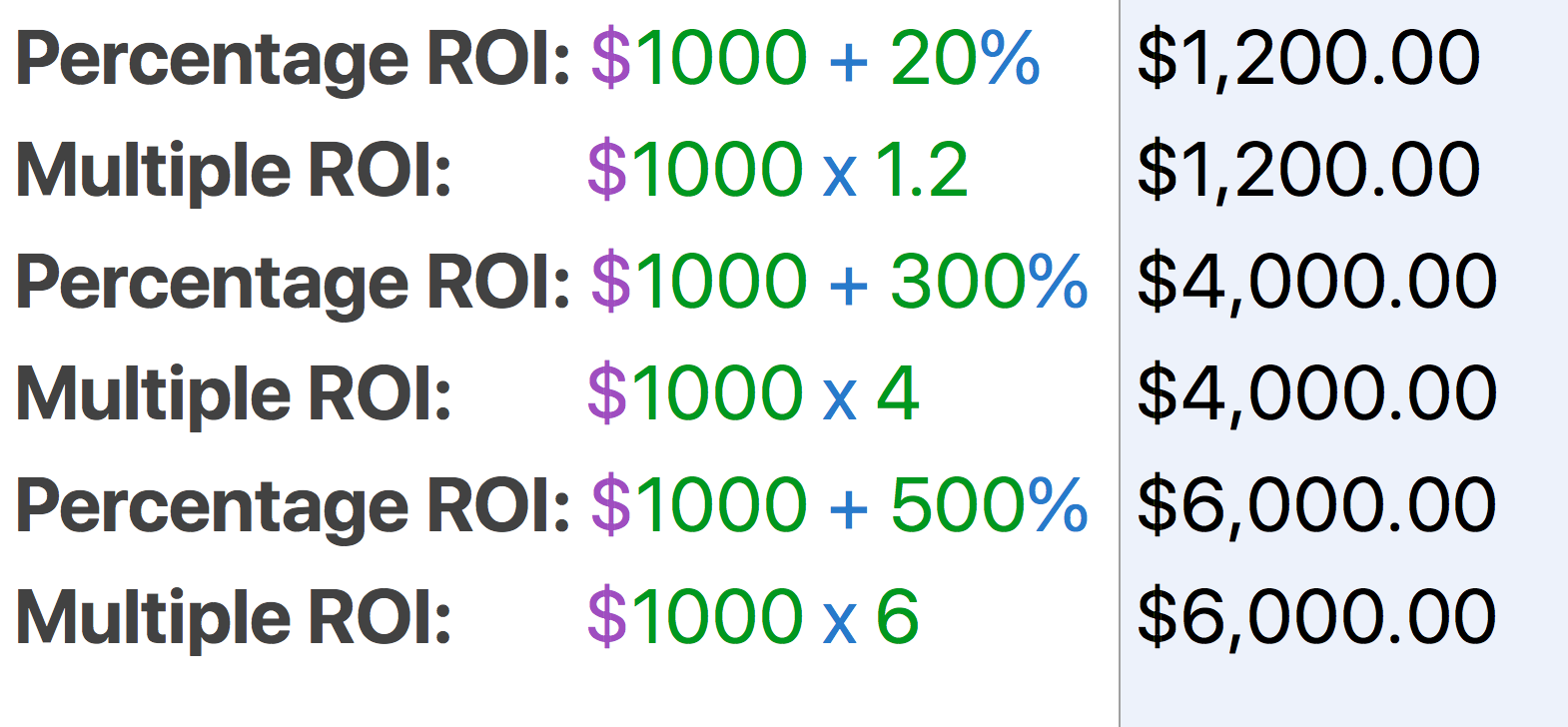

Keep It Simple

Here's yet another way to present the same information as the table above.

Resources

Finance: Calculating Annuities using ES6

Annuities are cool. They're fixed payments over a period of time. If you're living in England, there's another financial product called a...

Finance: College Fund and Loan Amount Estimator using Es6

Similar to my previous article, here are some formulas that can help you estimate how much you need to save for your kid's college tuition or...